Your employees will thank you today, and tomorrow. By offering GlobalCapital’s PENSION Pro plan as part of an employment contract, you can stand out from the crowd, as a recruiter that values their employees as individuals.

Offering PENSION Pro as an employer not only reaps benefits for employees, but also for the company itself.

Company benefits include:

- Increased employee motivation

- Employee financial protection

- High retention rate of staff

- Attraction of valuable professionals

- Employee performance and loyalty reward tools

- Premium values as company expenses

- Annual tax credits* up to €500 annually

- Contributions paid on behalf of an employee are tax deductible* up to €2.000 annually

Employee benefits include:

- Peace of mind for future finances

- Annual tax credits* up to €500 annually

- 30% tax free lump sum* at retirement

- Investment managed by professionals

- Protection in case of death

- Flexibility in investment contributions

- Fund switch options

* Conditions of eligibility include that the employee must be minimum 18 years old, tax resident in Malta and tax liability has to exceed the tax credit. Subsidiary Legislation 123.163 which may be subject to change in the future applies. The term ‘tax’ refers to current tax legislation which may change in the future. Tax treatment depends on your personal circumstances and may be subject to change in the future. For tax advice, please consult your tax consultant.

Download our brochure for more information on our Corporate Pension plan.

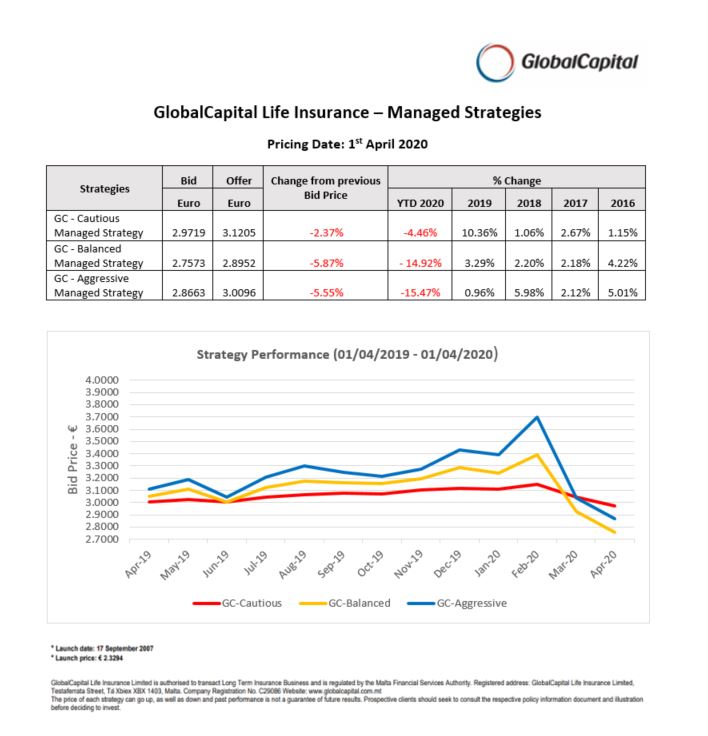

PENSION Pro - Unit Linked Strategies